Tax-exempt second amendment focused organizations have become increasingly prevalent in recent years, as gun ownership and the debate surrounding gun rights continues to be a highly contested topic in the United States. These organizations, which are typically classified as 501(c)(3) or 501(c)(4) tax-exempt entities, engage in a range of activities aimed at advancing the interests of gun owners and promoting the second amendment. This can include lobbying efforts, political campaigning, educational initiatives, and community outreach programs.

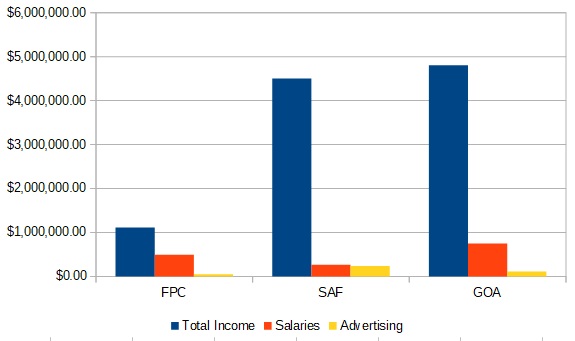

First comparison is FPC, SAF & GOA:

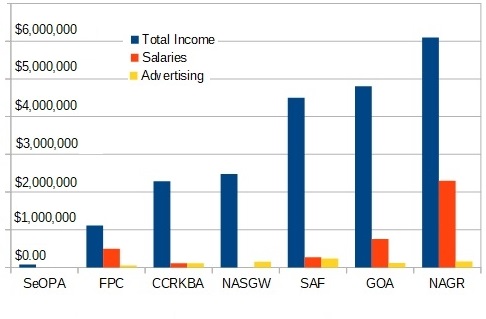

Next comparison is FPC, CCRKBA, NASGW, SAF, GOA & NAGR:

While these organizations enjoy certain tax benefits, they are subject to regulations and reporting requirements set forth by the Internal Revenue Service (IRS). As such, it is important for individuals and organizations involved in these activities to understand the legal and financial implications of tax-exempt status.

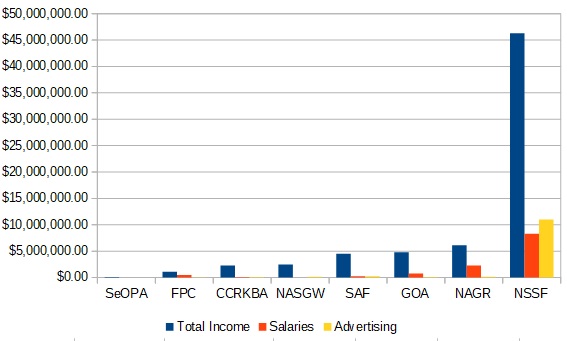

Next comparison is FPC, CCRKBA, NASGW, SAF, GOA, NAGR & NSSF:

NSSF hosts SHOT Show each year

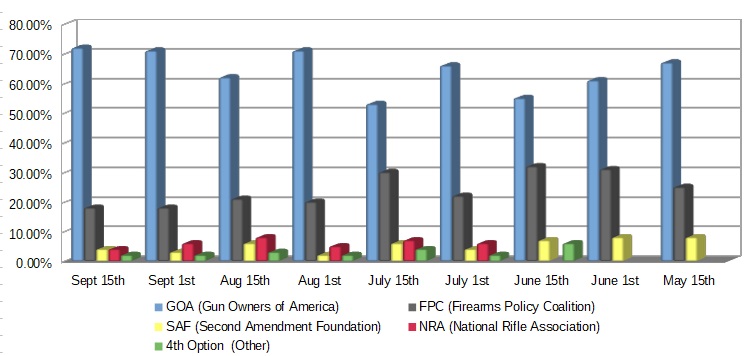

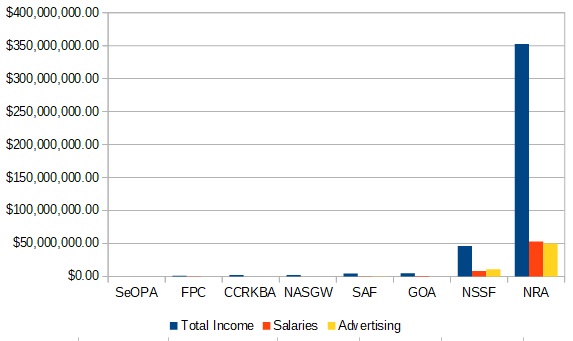

Now with NRA included for perspective:

Same chart this is how much larger the NRA is than them

First created this in 2022 with numbers current up to 2020

Then again in 2024 added the 2021 & 2022 numbers

2022 Results

- gun = 1,469 organization

- shooting = 587 organization

- rifle = 518 organization

- pistol = 281 organization

- nra = 7 organization

2024 Results

- gun = 1,716 organization

- shooting = 714 organization

- rifle = 574 organization

- pistol = 402 organization

- nra = 9 organization

NATIONAL RIFLE ASSOCIATION OF AMERICA

https://projects.propublica.org/nonprofits/organizations/530116130

- FAIRFAX, VA

- Tax-exempt since April 1944

- 501(c)(4)

- Donations to this organization are NOT tax deductible.

- 2022 = $211,332,026

- 2021 = $227,419,952

- 2020 = $291,155,464

- 2019 = $352,550,864

- 2018 = $311,987,734

- 2017 = $366,889,703

- 2016 = $336,709,238

- 2013 = $347,968,789

- 2012 = $256,290,928

- 2011 = $218,983,530

GUN OWNERS OF AMERICA INC

https://projects.propublica.org/nonprofits/organizations/521256643

- SPRINGFIELD, VA

- Tax-exempt since April 1978

- 501(c)(4)

- Donations to this organization are NOT tax deductible.

- 2022 = $6,995,508

- 2021 = $8,674,177

- 2020 = $6,197,962

- 2019 = $5,866,266

- 2018 = $4,802,572

- 2017 = $2,276,537

- 2016 = $2,259,601

- 2015 = $2,152,940

- 2014 = $1,943,077

- 2013 = $3,244,560

- 2012 = $2,358,893

- 2011 = $1,835,550

SECOND AMENDMENT FOUNDATION

https://projects.propublica.org/nonprofits/organizations/916184167

- BELLEVUE, WA

- Tax-exempt since April 1975

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2022 = $6,805,736

- 2021 = $7,369,700

- 2020 = $5,133,327

- 2019 = $4,487,488

- 2018 = $4,782,270

- 2017 = $3,960,911

- 2016 = $4,080,423

- 2015 = $4,079,691

- 2014 = $4,462,043

- 2013 = $5,829,479

- 2012 = $4,342,393

- 2011 = $3,894,695

NATIONAL ASSOCIATION FOR GUN RIGHTS INC

https://projects.propublica.org/nonprofits/organizations/542015951

- FREDERICKSBRG, VA

- Tax-exempt since May 2001

- 501(c)(4)

- Donations to this organization are NOT tax deductible

- 2022 = $10,395,246

- 2021 = $15,555,397

- 2020 = $9,802,484

- 2019 = $6,093,701

- 2018 = $6,697,870

- 2017 = $7,110,567

- 2016 = $10,706,602

- 2015 = $10,500,241

- 2014 = $12,451,900

- 2013 = $16,432,656

- 2012 = $7,124,924

- 2011 = $3,760,097

FIREARMS POLICY COALITION

https://projects.propublica.org/nonprofits/organizations/472460415

- Tax-exempt since Oct. 2015

- SACRAMENTO, CA 95814-3954

- 501(c)(4)

- Donations to this organization are NOT tax deductible.

- 2022 = $5,254,959

- 2021 = $6,404,219

- 2020 = $3,054,588

- 2019 = $1,213,441

- 2018 = $650,818

- 2017 = $1,112,364

- 2016 = $788,022

- 2015 = $61,522

NATIONAL SHOOTING SPORTS FOUNDATION INC

https://projects.propublica.org/nonprofits/organizations/60860132

- SHELTON, CT

- Tax-exempt since Jan. 1971

- 501(c)(6)

- Donations to this organization are NOT tax deductible

- 2022 = $57,068,690

- 2021 = $20,295,527

- 2020 = $46,704,892

- 2019 = $46,307,739

- 2018 = $44,022,322

- 2017 = $43,328,520

- 2016 = $36,278,652

- 2015 = $35,598,954

- 2014 = $34,345,801

- 2013 = $28,289,901

- 2012 = $26,874,457

JEWS FOR THE PRESERVATION OF FIREARMS OWNERSHIP INC

https://projects.propublica.org/nonprofits/organizations/391732344

- BELLEVUE, WA

- Tax-exempt since Dec. 1993

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2023 = $63,966

- 2022 = $53,903

- 2021 = $83,565

- 2020 = $69,930

- 2019 = $71,589

- 2018 = $84,877

- 2017 = $69,572

- 2016 = $127,851

- 2015 = $97,835

THE UNITED STATES PRACTICAL SHOOTING ASSOCIATION/IPSC

https://projects.propublica.org/nonprofits/organizations/911325053

- BURLINGTON, WA

- Tax-exempt since Aug. 1987

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2022 = $3,139,618

- 2021 = $2,856,892

- 2020 = $2,730,855

- 2019 = $2,708,276

- 2018 = $2,557,174

- 2017 = $2,229,232

- 2016 = $1,977,303

- 2015 = $1,843,400

U S A SHOOTING

https://projects.propublica.org/nonprofits/organizations/841263863

- COLORADO SPGS, CO

- Tax-exempt since Nov. 1994

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2022 = $5,876,660

- 2021 = $5,626,398

- 2020 = $4,154,250

- 2019 = $6,428,758

- 2018 = $7,016,907

- 2017 = $4,343,090

- 2016 = $5,386,549

- 2015 = $6,427,662

- 2014 = $6,191,288

- 2013 = $5,395,668

- 2012 = $5,455,518

- 2011 = $5,381,098

SCHOLASTIC SHOOTING SPORTS FOUNDATION INC

https://projects.propublica.org/nonprofits/organizations/208484121

- SAN ANTONIO, TX

- Tax-exempt since Dec. 2007

- 501(c)(3)

- Donations to this organization ARE tax deductible

- 2022 = $4,552,190

- 2021 = $4,300,906

- 2020 = $3,706,824

- 2019 = $3,723,496

- 2018 = $3,304,687

- 2017 = $3,444,798

- 2016 = $3,608,020

- 2015 = $3,422,553

- 2014 = $1,814,422

- 2013 = $1,970,881

- 2012 = $1,674,088

- 2011 = $640,100

NATIONAL SKEET SHOOTING ASSOCIATION A TEXAS CORP

https://projects.propublica.org/nonprofits/organizations/750108632

- SAN ANTONIO, TX

- Tax-exempt since April 1987

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2022 = $12,619,412

- 2021 = $11,184,020

- 2020 = $7,643,308

- 2019 = $10,110,467

- 2018 = $10,091,153

- 2017 = $10,135,811

- 2016 = $9,336,383

- 2015 = $8,858,395

NATIONAL MUZZLE LOADING RIFLE ASSOCIATION

https://projects.propublica.org/nonprofits/organizations/351046434

- FRIENDSHIP, IN

- Tax-exempt since April 1991

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2020 = $1,259,575

- 2019 = $1,749,807

- 2018 = $1,460,618

- 2017 = $1,656,286

- 2016 = $1,546,683

- 2015 = $1,797,146

- 2014 = $2,051,889

- 2013 = $1,647,403

- 2012 = $1,461,929

- 2011 = $1,530,091

NEBRASKA FIREARMS OWNERS ASSOCIATION

↳ NFOA

https://projects.propublica.org/nonprofits/organizations/263679369

- OMAHA, NE

- Tax-exempt since June 2014

- 501(c)(4)

- Donations to this organization are NOT tax deductible

- 2020 = small organization (less than $50,000 in gross receipts)

BUCKEYE FIREARMS ASSOCIATION INC

https://projects.propublica.org/nonprofits/organizations/464076332

- GREENVILLE, OH

- 2020 =

- 2019 =

- 2018 =

- 2017 =

- 2016 =

- 2015 =

| Key Employees and Officers | Compensation |

| DEAN RIECK (EXECUTIVE DI) | $36,000 |

| JAMES IRVINE (PRESIDENT) | $0 |

| LINDA WALKER (VICE PRESIDE) | $0 |

| JOSEPH EATON (TREASURER) | $0 |

| CHAD BAUS (SECRETARY) | $0 |

| SEAN MALONEY (BD MEMBER) | $0 |

| BRAD BIRCHFIELD (BD MEMBER) | $0 |

BUCKEYE FIREARMS FOUNDATION INC

https://projects.propublica.org/nonprofits/organizations/261239294

- BLUE CREEK, OH

- Tax-exempt since Nov. 2008

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2020 = $440,368

- 2019 = $418,544

- 2018 = $428,429

- 2017 = $303,300

- 2016 = $253,669

- 2015 = $254,365

REALIZE FIREARMS AWARENESS COALITION

https://projects.propublica.org/nonprofits/organizations/463377299

- WAYLAND, OH

- Tax-exempt since June 2014

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2020 = small organization (less than $50,000 in gross receipts)

SOUTHERN ARIZONA FIREARMS EDUCATORS INC

https://projects.propublica.org/nonprofits/organizations/860730875

- TUCSON, AZ

- Tax-exempt since Dec. 2021

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2020 = small organization (less than $50,000 in gross receipts)

ASSOCIATION OF FIREARMS HISTORY AND MUSEUMS

https://projects.propublica.org/nonprofits/organizations/834657349

- CODY, WY

- Tax-exempt since May 2019

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2020 = small organization (less than $50,000 in gross receipts)

NRA SOUTHERN ARIZONA FIELD SUPPORT TEAM INC

https://projects.propublica.org/nonprofits/organizations/861002012

- TUCSON, AZ

- Tax-exempt since April 2001

- 501(c)(4)

- Donations to this organization are NOT tax deductible

- 2018 = $28,059

- 2017 = $16,340

- 2016 = $6,822

- 2015 = $32,645

- 2014 = $19,228

- 2013 = $37,250

- 2012 = $26,312

- 2011 = $14,632

| Key Employees and Officers | Compensation |

| DANIEL P DEWEY (PRESIDENT AND TREASURER) | $0 |

| LOIS CHEDSEY (SECRETARY) | $0 |

TEXAS STATE RIFLE ASSOCIATION

https://projects.propublica.org/nonprofits/organizations/237361568

- BASTROP, TX

- Tax-exempt since June 1951

- 501(c)(4)

- Donations to this organization are NOT tax deductible

- 2020 = $687,188

- 2019 = $921,071

- 2018 = $967,554

- 2017 = $742,700

- 2016 = $970,149

- 2015 = $1,374,557

- 2014 = $1,163,106

- 2013 = $1,680,632

- 2012 = $1,397,989

- 2011 = $1,107,660

TUCSON RIFLE CLUB INC

https://projects.propublica.org/nonprofits/organizations/860257118

- TUCSON, AZ

- Tax-exempt since Jan. 1998

- 501(c)(4)

- Donations to this organization are NOT tax deductible

- 2020 = $229,514

- 2019 = $201,955

- 2018 = $206,652

- 2017 = $151,959

- 2016 = $203,244

- 2015 = $139,415

- 2014 = $137,164

- 2013 = $153,705

- 2012 = $148,226

- 2011 = $138,942

CALIFORNIA RIFLE AND PISTOL ASSOCIATION INC

https://projects.propublica.org/nonprofits/organizations/952258096

- FULLERTON, CA

- Tax-exempt since June 1984

- 501(c)(4)

- Donations to this organization are NOT tax deductible

- 2020 = $2,415,179

- 2019 = $1,861,371

- 2018 = $1,899,503

- 2017 = $1,704,096

- 2016 = $1,410,267

- 2015 = $1,255,860

- 2014 = $1,287,951

- 2013 = $1,256,665

- 2012 = $899,804

- 2011 = $1,506,342

DESERT SPORTSMANS RIFLE AND PISTOL CLUB INC

https://projects.propublica.org/nonprofits/organizations/880229448

- LAS VEGAS, NV

- Tax-exempt since Dec. 1998

- 501(c)(7)

- Donations to this organization are NOT tax deductible

- 2020 = $516,025

- 2019 = $440,293

- 2018 = $433,058

- 2017 = $405,328

- 2016 = $355,401

- 2015 = $262,258

- 2014 = $215,060

- 2013 = $215,767

- 2012 = $252,483

- 2011 = $245,400

- 2010 = $303,021

NEW YORK STATE RIFLE & PISTOL ASSOCIATION INC

https://projects.propublica.org/nonprofits/organizations/146032535

- E GREENBUSH, NY

- Tax-exempt since Aug. 1966

- 501(c)(4)

- Donations to this organization are NOT tax deductible

- 2020 = $457,368

- 2019 = $495,484

- 2018 = $375,793

- 2017 = $385,938

- 2016 = $428,320

- 2015 = $510,834

- 2014 = $540,508

- 2013 = $1,141,270

- 2012 = $301,700

- 2011 = $230,726

ASSOCIATION OF NEW JERSEY RIFLE & PISTOL CLUBS INC

https://projects.propublica.org/nonprofits/organizations/221911024

- NORTH HALEDON, NJ

- Tax-exempt since April 1971

- 501(c)(7)

- Donations to this organization are NOT tax deductible

- 2020 = $1,454,828

- 2019 = $1,410,041

- 2018 = $1,549,673

- 2017 = $1,463,717

- 2016 = $1,403,664

- 2015 = $1,211,977

- 2014 = $1,221,362

- 2013 = $1,314,781

- 2012 = $1,167,294

- 2011 = $912,356

CORPORATION FOR THE PROMOTION OF RIFLE PRACTICE AND FIREARMS SAFETY

↳ CIVILIAN MARKSMANSHIP PROGRAM

https://projects.propublica.org/nonprofits/organizations/341839195

- ANNISTON, AL

- Tax-exempt since May 2006

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2020 = $32,208,811

- 2019 = $24,730,352

- 2018 = $22,635,695

- 2017 = $33,464,155

- 2016 = $20,134,510

- 2015 = $23,164,372

- 2014 = $25,244,883

- 2013 = $35,343,319

- 2012 = $31,750,872

- 2011 = $28,497,239

WATERFORD WOLVERINE SHOOTING TEAM INC

https://projects.propublica.org/nonprofits/organizations/472340836

- WATERFORD, WI

- Tax-exempt since Nov. 2014

- 501(c)(3)

- Donations to this organization ARE tax deductible.

- 2020 = $141,056

- 2019 = $105,077

- 2018 = $84,692

- 2017 = $45,349

- 2016 = $54,744

- 2015 = $48,686

- 2014 = $500

SOCIALIST RIFLE ASSOCIATION INC

https://projects.propublica.org/nonprofits/organizations/832146166

- WICHITA, KS

- Tax-exempt since Feb. 2019

- 501(c)(4)

- Donations to this organization are NOT tax deductible

- 2019 = $97,218

| Key Employees and Officers | Compensation |

| (Secretary) | $11,316 |

| (President) | $9,129 |

| (Treasurer) | $1,339 |

| (Secretary) | $1,028 |

- Gun Rights Groups

- National Gun Rights Groups

- State Gun Rights Groups

- Gun Rights Groups Timeline

- Gun Owners Rights Group Funding

- Past SHOT Shows

- Gun Right Policy Conference

- NRA Meetings

- 2A Rallys

- 2A Events

- Yearly Firearm Events